Is Tax Clearance Certificate mandatory as per Budget 2024-25 for all those going abroad? Fact Check

Claim: Under 2024-25 Budget rules, all persons going abroad should obtain Income Tax Clearance Certificate effective Oct. 1, 2024.

Conclusion: Misrepresentation. The Income Tax Clearance Certificate will be required only by those Indian citizens before going abroad with tax litigation or liabilities amounting to more than Rs. 10 lakhs.

Rating: Misrepresentation — ![]()

Click the image ![]() to see the complete fact check details in video.

to see the complete fact check details in video.

Or Read the article below.

************************************************************************

After the Budget 2024-25 presentation, several claims have been making the rounds and one such says that all Indian citizens should obtain a tax clearance certificate from the Income Tax authorities before going abroad. It further states that the new regulation would come into effect from October 1, 2024.

The Finance Bill, 2024 has mandated that any person domiciled in India would require an income tax clearance certificate to leave the countryhttps://t.co/cUwByEYvgj

— Business Today (@business_today) July 26, 2024

The claim has gone viral on X with the Business Today news report that said, “The Finance Bill, 2024 has mandated that any person domiciled in India would require an income tax clearance certificate to leave the country.”

The claims can be accessed here and here.

FACT CHECK

The issue of IT Clearance certificate has been made in the Budget 2024-25 presentation. According to the Budget 2024-25, the new law requires individuals domiciled in India to clear all tax dues and get ‘clearing certificates’ before departing the country.

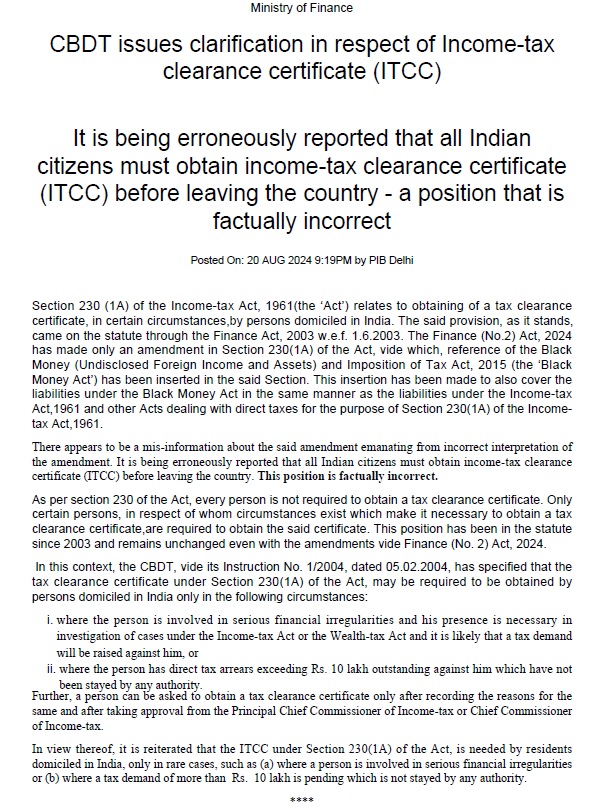

Following the debate over the new provision on news and social media, the Finance Ministry clarified that this modification does not require all individuals to obtain a tax clearance certificate but applies to those with financial irregularities or major tax arrears pending before the Income Tax authorities.

The Central Board of Direct Taxes (CBDT) also clarified the same in its statement on August 20, 2024 that the certificate was not required for every person but only for those with financial irregularities or those who owed direct tax arrears exceeding Rs 10 lakh. See the full text here.

The statement said, “… the CBDT, vide its Instruction No. 1/2004, dated 05.02.2004, has specified that the tax clearance certificate under Section 230(1A) of the Act, may be required to be obtained by persons domiciled in India only in the following circumstances:

– where the person is involved in serious financial irregularities and his presence is necessary in investigation of cases under the Income-tax Act or the Wealth-tax Act and it is likely that a tax demand will be raised against him, or

– where the person has direct tax arrears exceeding Rs. 10 lakh outstanding against him which have not been stayed by any authority.”

Hence, the claim that all persons are required to obtain IT Clearance Certificate before going abroad is false.

Also Read:

Did India ‘buy’ 28 islands from Maldives? Fact Check

Did Vinesh Phogat weigh 2.1 kg more before her disqualification in Paris Olympics? Fact Check